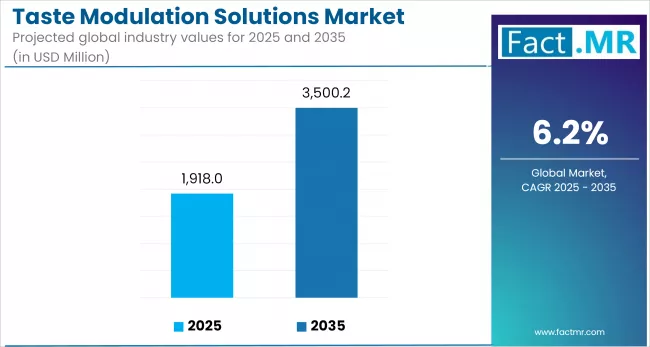

Taste Modulation Solutions Market is Forecasted to Reach USD 3,500 Million by 2035

The Sweet Modulators segment is projected to grow at a CAGR of 6.7%, whereas another segment Salt Modulators is likely to grow at 5.8%.

ROCKVILLE, MD, UNITED STATES, July 24, 2025 /EINPresswire.com/ -- The Global Taste Modulation Solutions Market, valued at USD 1,832 million in 2024, is projected to reach USD 3,500 million by 2035, growing at a compound annual growth rate (CAGR) of 6.2%, according to industry analysis. The market’s expansion is driven by rising health-conscious consumer behavior, regulatory pressure for sugar and sodium reduction, and growing demand for clean-label products across food, beverage, and nutraceutical industries.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=672

Drivers of Demand for Taste Modulation Solutions

The surge in demand for taste modulation solutions is propelled by increasing consumer awareness of health and wellness, driven by rising incidences of obesity, diabetes, and cardiovascular diseases. The World Health Organization’s recommendation to limit sugar intake to less than 10% of daily energy and sodium reduction guidelines has pushed manufacturers to reformulate products. Taste modulators enable reduced sugar, salt, and fat content while preserving sensory appeal, addressing consumer aversion to artificial additives. The growing popularity of plant-based and vegan foods, often challenged by bitterness or off-notes, further fuels demand for modulators to enhance palatability. Regulatory frameworks, such as the FDA’s sodium reduction targets and EU’s nutritional labeling mandates, compel manufacturers to adopt these solutions. Additionally, consumer preference for clean-label products drives investment in natural and botanical modulators, aligning with the demand for transparency and healthier formulations.

Emerging Formulation and Technology Trends

The taste modulation solutions market is witnessing a shift toward plant-based and botanical modulators, aligning with the clean-label trend. Innovations include AI-driven sensory science to optimize flavor profiles and hybrid modulation systems combining sweetness enhancers, bitterness blockers, and salt boosters for complex formulations. Regional-specific solutions tailored to local cuisines, such as umami enhancers for East Asian markets or spice modulators for South Asia, are gaining traction. Encapsulated modulators, offering controlled flavor release and stability, are increasingly used in functional foods, nutraceuticals, and beverages. Strategic collaborations between flavor houses and food manufacturers are accelerating prototyping and commercialization. For instance, advancements in microencapsulation and natural sweeteners like stevia and monk fruit are enhancing modulator performance in low-calorie and sugar-free products, particularly in beverages and snacks.

Challenges Limiting Market Growth

High R&D costs and complex formulation processes pose barriers, particularly for small and medium-sized manufacturers. Regulatory approvals for new modulators, varying by region (e.g., FDA, EFSA), are time-consuming and costly, delaying market entry. Consumer skepticism toward unfamiliar or masked flavors, especially in less transparent formulations, can hinder acceptance. Technical challenges, such as maintaining flavor stability under diverse processing conditions (e.g., high temperatures or pH variations), complicate adoption. In developing markets, limited awareness of taste modulation benefits slows growth, requiring education and innovation to overcome resistance.

Regional Insights: North America, East Asia, and Western Europe Lead

North America, led by the U.S., holds the largest market share (36.7% in 2024), driven by a robust food and beverage industry, high consumer awareness, and regulatory initiatives like the FDA’s sodium reduction guidelines. Demand for low-calorie, functional beverages and clean-label snacks fuels growth, with a projected CAGR of 6.5% through 2035.

East Asia, particularly China, Japan, and South Korea, is the fastest-growing region with a CAGR of 9.2%, driven by urbanization, rising disposable incomes, and health-conscious consumption. China’s market, valued at USD 192.8 million in 2024, benefits from demand for low-sugar and functional foods, supported by local R&D investments.

Western Europe, led by Germany, France, and the UK, is driven by stringent sugar and salt regulations and consumer preference for clean-label products.

Country-Wise Outlook

United States: The U.S. market is propelled by demand for nutrient-enriched, low-calorie bakery and beverage products. Innovations in clean-label modulators, such as organic sweeteners, align with consumer trends toward functional and wellness-focused foods. The artisanal and frozen dough markets further drive adoption.

Germany: Germany’s market thrives on clean-label and artisanal baking trends, with high demand for natural modulators in whole-grain and high-protein products. Strict EU regulations and consumer preference for organic certifications fuel growth.

China: Rapid urbanization and health awareness drive China’s market, with demand for low-sugar, low-fat bakery and functional beverages. Investments in taste modulation technologies and regional flavor solutions support a projected CAGR of 6.8% through 2035.

Category-Wise Analysis

Sweet Modulators: Dominating with a 47.7% share in 2024, sweet modulators are driven by sugar reduction mandates and demand for low-calorie beverages, bakery, and dairy products. Innovations like stevia-based enhancers fuel an 8.0% CAGR.

Natural Modulators: Growing rapidly due to clean-label trends, natural modulators (e.g., botanical extracts) are preferred for their transparency and alignment with consumer distrust of artificial additives.

Encapsulated Forms: Encapsulated modulators, offering stability and controlled release, are gaining traction in dairy, nutraceuticals, and snacks, driven by complex formulation needs.

Buy Report – Instant Access: https://www.factmr.com/checkout/672

Competitive Landscape

Key players include Givaudan, DSM-Firmenich, Kerry Group, International Flavors & Fragrances (IFF), Ingredion, Sensient Technologies, Symrise AG, Tate & Lyle, ADM, and Flavorchem Corporation. Givaudan’s TasteSolutions and Kerry’s Tastesense lead in sugar and salt reduction, while DSM-Firmenich’s ModulaSENSE targets plant-based proteins. Recent developments include HealthTech BioActives’ flavonoid-based modulators (November 2024) and Imbibe’s Certified Organic Senses® (August 2024), addressing organic and clean-label demands. Companies are investing in AI, biotechnology, and natural ingredient R&D to meet regulatory and consumer needs.

Future Outlook: Health and Innovation Drive Growth

In the short term (2025-2028), demand for low-sugar and low-sodium products will drive adoption in beverages and snacks. The medium term (2028-2032) will see East Asia and Western Europe lead due to regulatory pressures and R&D investments. In the long term (2032-2035), advancements in natural and encapsulated modulators will sustain the 6.2% CAGR, with nutraceuticals and plant-based foods as key growth areas.

Check out More Related Studies Published by Fact.MR Research:

Probiotic agricultural cleaning solutions market is expected to grow at a CAGR of 4.8%, reaching value of $3.6B by 2035, U.S. is expected to grow 6% by 2035.

Air-based foods market is valued at $4.1B in 2025 & is projected to grow at a 12.5% CAGR

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release